The Government’s Help to Buy Mortgage Guarantee scheme launched early

The next phase of the Government’s Help to Buy scheme is to launch to buyers next week, three months earlier than anticipated.

The next phase of the Government’s Help to Buy scheme is to launch to buyers next week, three months earlier than anticipated.

If you want to get on or move up the housing ladder but find the large deposit required with current mortgages a struggle, this scheme could make buying more accessible for you.

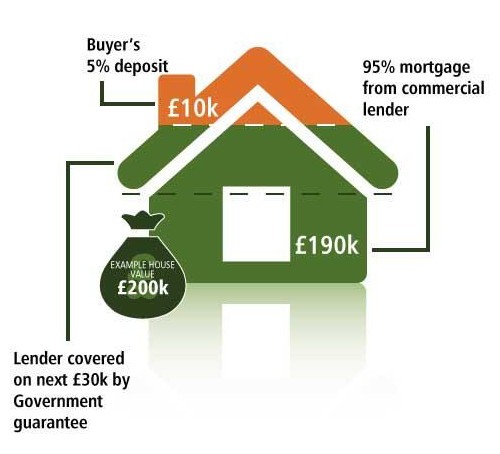

You can start applying for a mortgage under the Help to Buy scheme from the week commencing 7th October. Under the scheme, you can move with as a little as a 5% deposit to any property under £600,000 – be it a new build OR pre-loved home.

What is the Mortgage Guarantee scheme?

The Government will be supporting lenders to offer up to 95% mortgages, helping buyers with smaller deposits to get on the property ladder, trade up or move to a another property.

Below is a quick checklist on what is involved in the scheme:

Want to know more?

Full details of the scheme have not been released publically yet, but register with us and we’ll send you more information on the scheme.

For more information about the Help to Buy schemes available, click here