How much would you pay for an extra bedroom?

Thousands of home-movers are looking to buy a bigger house this autumn, but the cost of trading up is getting more expensive.

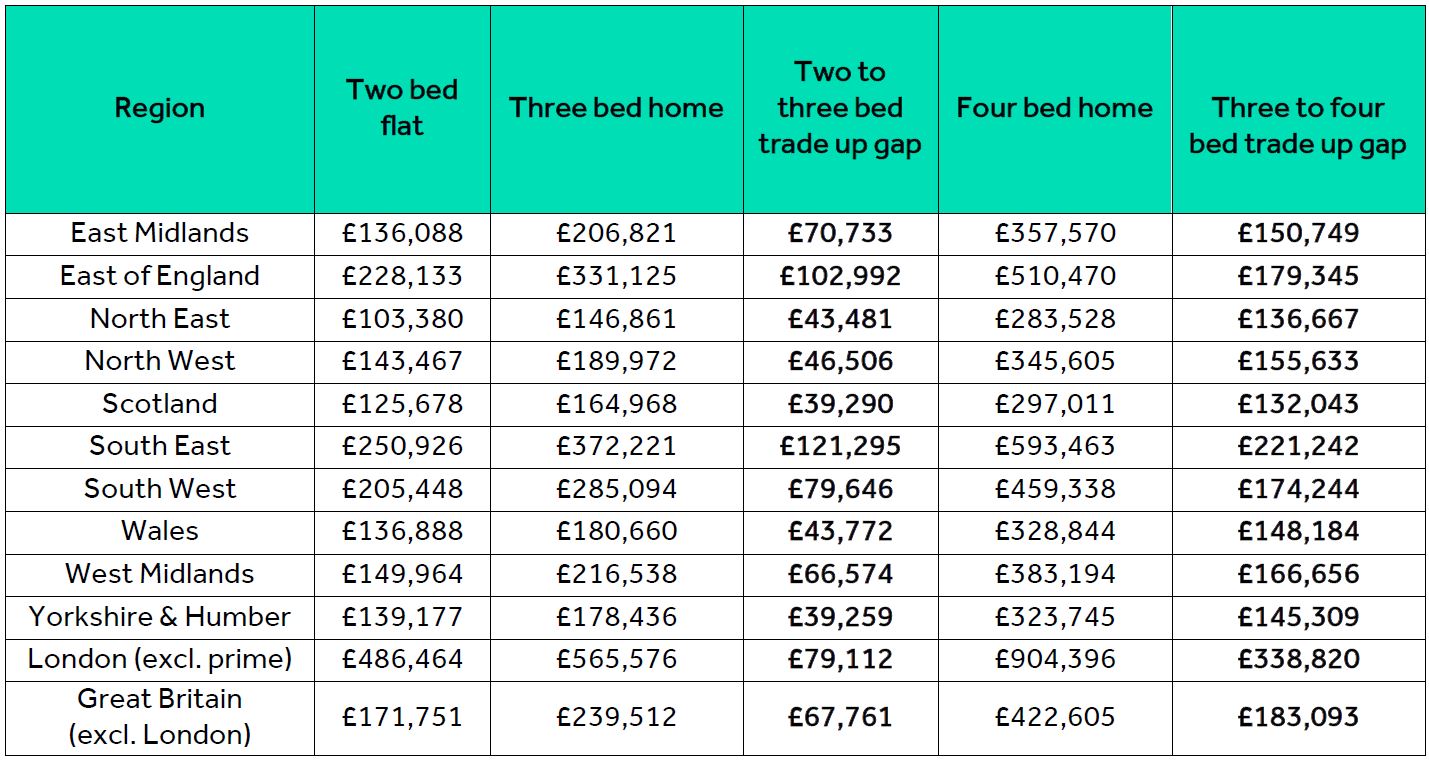

A recent study by our data analysts found that buyers are having to pay almost £68,000 on average to move from a two-bed flat to a three-bed house outside London.

This is £4,000 more than this time last year and illustrates just how in-demand properties further up the property ladder are right now.

Over the past five years, the price growth of three-bedroom houses has outstripped the price growth of two-bedroom flats every year.

What are the headlines figures?

- Asking prices of two-bed flats have increased by 15% over the past five years

- Asking prices of three-bed houses have jumped by 20%, leading to the record trade up gap

- The smallest jump from a two-bed to a three-bed is in Swansea where the difference is £11,000 on average

- The biggest jump is in Esher, Surrey, where there is a £300,000 difference

- The trade up gap increases to over £183,000 for those trying to make the jump from a three-bed house to a four-bed house, up from £180,000 last year

As our table shows, in the East of England the two to three bed trade up gap is now over £100,000 for the first time, while the biggest trade up gap is in the South East, at £121,295.

Analysis for London shows a trade up gap of £79,112, rising from an average of £486,464 for a two-bed flat, to £565,576 for a three-bed house.

Those trying to move from a three to a four bed home, potentially for extra rooms to work from home, will need to contend with an even bigger jump of £183,093 outside London, with asking prices growing by 15% over the past five years.

In London, average asking price growth for four-bed homes has grown by 10% over the last five years, as this property type actually dropped in value between 2016 and 2018.

However, the trade up gap varies dramatically at a local level. For example, in Swansea, a move from a two-bed flat to a three-bed home has a difference of only £11,000, whereas in Esher in Surrey there is a massive £300,000 difference.

What do the experts say?

Our resident property data expert Tim Bannister explained that buyers who are finding it challenging to trade up should try casting their net further afield to get more for their money.

He said: “People who bought a smaller home five years ago and are now hoping to trade up will find it’s harder to afford the next rung of the ladder because of the different pace of the sectors.

“Those who really need the space and are struggling to trade up could widen their search area to find alternative places where they can get more for their money, or they may need to compromise on the type of home and opt for a terraced rather than detached.

“The cash jump is even bigger from three to four beds, likely due to four bed homes often having additional bathrooms, bigger gardens, garages or outbuildings, as well as an extra bedroom, but traditionally homeowners stay in their second home longer and so more people may have built up enough equity to make the jump to their forever home.”

So, what can you do to find more space and that extra bedroom you desire? Well, why not start by checking out our Where can I live feature?

READ MORE: How will the new rules affect your move?